Extract your max

tax depreciation.

Any property that generates an income benefits from an ATO-compliant depreciation schedule. Let us hunt down your ‘Untaxable’ amount to maximise your deductions. Residential, commercial, retail, manufacturing and hotels - all reports are personally built by Liam Hannah - quantity surveyor and supplied the way the your accountant needs them.

Extract your max

tax depreciation.

Extract your max tax depreciation.

Any property that generates an income benefits from an ATO-compliant depreciation schedule. Let us hunt down your ‘Untaxable’ amount to maximise your deductions. Residential, commercial, retail, manufacturing and hotels - all reports are personally built by Liam Hannah - quantity surveyor and supplied the way the your accountant needs them.

Tax depreciation

is a line item.

Not a loophole.

Our ATO-compliant depreciation schedules hunt down your ‘Untaxable’ amount to maximise your deductions. All reports are personally built by Liam Hannah - quantity surveyor and supplied the way the your accountant needs them.

We cover all property investments

Untaxable creates a bespoke report for your property to maximise deductions.

Residential - new build

Residential - second hand

Residential - house & land

Residential - architectural

Residential - short term lets

Residential - multi-dwelling

Commercial - warehouse

Commercial - small retail

Comercial - retail

Commercial - office

Commercial - manufacturing

Commercial - hotels

The Untaxable benefits

Built by a professional, not a platform.

Each report is prepared by Liam Hannah, a registered quantity surveyor.

Accountant-friendly format

We provide designer formatted summaries AND .xls files perfect for your accountant’s workflow.

ATO audit-ready

Every schedule is calculated ATO compliant and defensible to the decimal.

Scrapping built in

No separate reports. Individual assets write-offs are now baked-in - unique to Untaxable.

Chat without the chatbot

No help-desk tickets. No offshore support. Just straight answers from Liam over the phone.

Update your reports

$120 +gst flat fee for any update even if it’s months or years on. No full recharge.

3-Day or 24hr turnaround

Standard delivery is 3 business days. But we offer 24hr turnaround for those on a deadline.

A streamlined inspection free process that respects your time.

From start to finish, you’ll be dealing with the same person, Liam, person who signs the report.

Book a call

We’ll confirm your property type, answer questions and outline exactly what’s needed.

Provide property details

Complete a short online checklist-contract of sale, inclusions list or renovation info.

Build the report

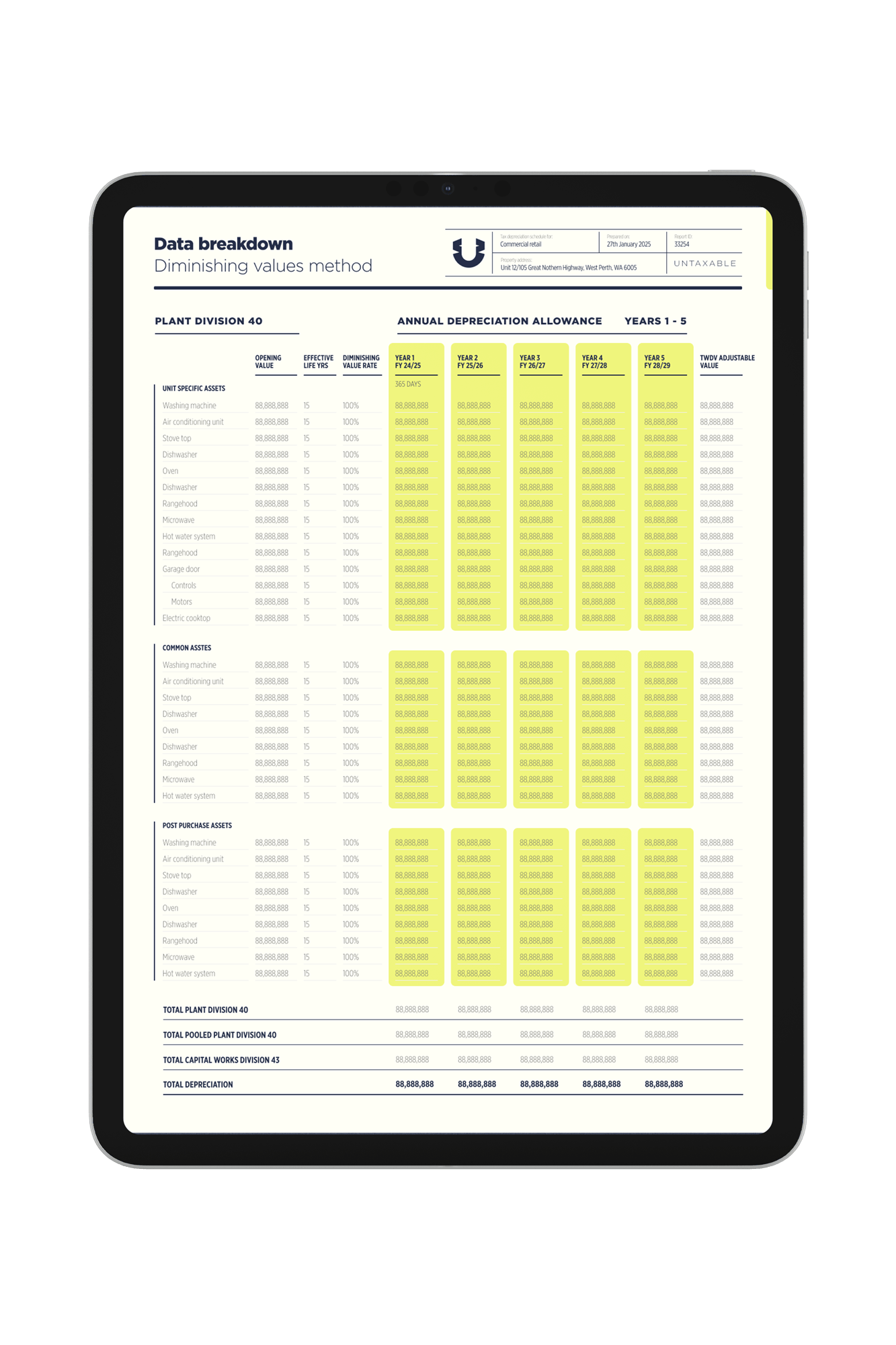

We itemise every asset and calculate both Prime Cost and Diminishing Value schedules.

3 days or 24h later

Get a full ATO- and accountant-ready schedule - with .xls data in 3 business days or 24hrs.

Fast updates, anytime

Renovated? Replaced assets? We’ll update your schedule for a flat fee of $120 +gst.

Clear pricing.

Clear reports.

Human service.

Every Untaxable report is personally prepared by Liam Hannah - Quantity Surveyor. No AI-generated templates. Just professional, maximised, defensible schedules - built for accountants (excel files supplied) and ready for the ATO.

Standard turnaround is 3 business days. Need it faster? Choose 24-hour express.

Tax Depreciation Reports

Unlock the potential of your investment property today.

Standard

Typical investment homes, townhouses, and apartments.

$495 +gst

Residential:

Architectural

Custom builds and prestige dwellings that feature high-quality materials and top-end appliances.

Commercial:

Small

Offices, retail, cafés, and smaller commercial spaces.

Commercial:

Medium- Large

Larger or multi-storey commercial sites requiring broader assessment.

Manufacturing /

Industrial

Warehouses, industrial units, or properties with significant manufacturing plant or equipment.

Hotels / Short-Stay Accommodation

Boutique hotels, short-stay accommodation, or serviced apartments. Quoted based on complexity.

Update Existing Report

Revise a previous Untaxable report to reflect renovations or changes. No full rebuild required.

Optional Add-ons

24-Hour Turnaround – $150 +gst

On a deadline? Jump the queue and get it next day.

Scrapping upgrade – $120 +gst

No separate report. Dynamic software allows for write-offs and auto-updates schedules.

Tax depreciation report pricing

Transparent capped pricing on most reports. Call for a quote on medium/large commercial, industrial, manufacturing, hotels and short-stay accommodation.

Residential

Standard

Typical investment homes, townhouses and apartments.

- Total allowances overview

- Post-purchase integration

- Prime & diminishing methods

- 40yrs in full & summarised

- Grouped depreciation rates

- Capital works / buildings

- Working Excel/CSV file

- Hotline access to Liam

- Add-on - Scrapping integration

- Add-on - 24 hr turnaround

Residential

Architectural

Custom builds and prestige dwellings that feature high-quality materials and top-end appliances.

- Total allowances overview

- Post-purchase integration

- Prime & diminishing methods

- 40yrs in full & summarised

- Grouped depreciation rates

- Capital works / buildings

- Working Excel/CSV file

- Hotline access to Liam

- Add-on - Scrapping integration

- Add-on - 24 hr turnaround

Commercial

Standard

Offices, retail, cafés and smaller commercial spaces.

- Total allowances overview

- Post-purchase integration

- Prime & diminishing methods

- 40yrs in full & summarised

- Grouped depreciation rates

- Capital works / buildings

- Working Excel/CSV file

- Hotline access to Liam

- Add-on - Scrapping integration

- Add-on - 24 hr turnaround

Commercial

Medium–Large

Larger or multi-storey commercial sites requiring broader assessment.

- Total allowances overview

- Post-purchase integration

- Prime & diminishing methods

- 40yrs in full & summarised

- Grouped depreciation rates

- Capital works / buildings

- Working Excel/CSV file

- Hotline access to Liam

- Add-on - Scrapping integration

- Add-on - 24 hr turnaround

Commercial

Industrial & manufacturing

Warehouses, industrial units, or properties with significant manufacturing plant or equipment.

- Total allowances overview

- Post-purchase integration

- Prime & diminishing methods

- 40yrs in full & summarised

- Grouped depreciation rates

- Capital works / buildings

- Working Excel/CSV file

- Hotline access to Liam

- Add-on - Scrapping integration

- Add-on - 24 hr turnaround

Commercial

Hotels &

short-stay accommodation

Boutique hotels, short-stay accommodation, or serviced apartments. Quoted based on complexity.

- Total allowances overview

- Post-purchase integration

- Prime & diminishing methods

- 40yrs in full & summarised

- Grouped depreciation rates

- Capital works / buildings

- Working Excel/CSV file

- Hotline access to Liam

- Add-on - Scrapping integration

- Add-on - 24 hr turnaround

Update Existing Report

Revise a previous Untaxable report to reflect renovations or changes. No full rebuild required.

$120+gst

24-Hour Turnaround

On a deadline? Jump the queue and get it next day.

$120+gst

Scrapping Upgrade

No separate report. Dynamic software allows for write-offs and auto-updates schedules.

$120+gst

Dynamic scrapping uniquely built into Untaxable reports

Your investment evolves. So should your schedule, no separate reports required. Most depreciation schedules are static. Ours aren’t. At Untaxable, we dynamically update your schedule as assets are replaced, upgraded, or written off - without needing a separate report.

We’re the first in market to offer scrapping built directly into your depreciation schedule. No duplicate admin. No back-and-forth. Just a clean, updated report that captures every dollar you’re entitled to.

Need to scrap an item? Let us know. We’ll update your schedule—fast, clean, and audit-ready. Scrapping upgrade – $120 +gst (flat fee)

Schedule Your Free Consultation

Get expert advice on tax depreciation today!